Frequently Asked Questions

Questions about the process

-

How do I register a CH-login?

Users with a Swiss mobile number:

The video How to register a CH-LOGIN shows you how to access federal web applications that require you to log in. You will be guided through the registration process for your CH-LOGIN, using job-room.ch as an example. CH-LOGIN is your personal key to the federal government’s applications.Users without a Swiss mobile number:

You need an authenticator app as a second factor. You can find instructions here: CH-LOGIN – Adding the Authenticator App as Second Factor — eIAM Help Pages -

How do I connect a company, foundation, etc. to EasyGov or request a VAT number?

- Register with EasyGov (see the reply above).

- Log in to EasyGov and click on the blue button «Click here to get started».

- Answer the questions by clicking on the following options:

- ‘I would like to use official services for a company in Switzerland or abroad (or an association, foundation, self-employed person registered in a register, etc.) or set up a company based in Switzerland.’

then

‘I would like to connect an existing company based in Switzerland or abroad (or an association, foundation, self-employed person registered in a register, etc.) or apply for a UID.’

then

‘The company is based in Switzerland / abroad’ (both options are possible)

At the end of the questions, the ‘Company Search’ search field appears on a new page. Enter the name of your company/foundation or the existing UID number and click on the ‘Search’ button. - Select your company or foundation and click on the brown ‘Connect’ button.

- If your company does not appear in the search results and therefore does not yet have a UID, click on the ‘Apply for UID’ button.

- You will be redirected to a new page where you can apply for a UID for companies based abroad.

Registration procedure for short-term employment of up to 90 days:

You can use the registration procedure directly as soon as you have applied for the UID. You do not have to wait until you have received the UID.

(This is an exception to all other official services on EasyGov and is to ensure that you can comply with the advance notification period of 8 days).What happens next?

Within the next few days, a power of attorney letter will be sent to the registered office of your company or foundation. Please sign this power of attorney and send it back using the enclosed reply envelope. Please note that your company or foundation can only be activated on EasyGov once you have sent back the power of attorney. This is necessary to ensure that your foundation or company data is kept secure. Thank you for your understanding. -

How much does using EasyGov cost?

Using the platform EasyGov is free of charge. However, costs may occur when registering your company with the Commercial Register, VAT on your turnover or OASI contributions. These costs also would occur if you had registered your company through conventional channels. Registering your company via EasyGov is not cheaper or more expensive, but it saves time that you can use for your core business.

-

How does EasyGov work?

You will be guided through various steps where you can input the required data. Explanations and examples will help you provide the correct information. Before transmitting the data electronically, or printing out a signature-ready document, you will always have the opportunity to check that all the information is correct.

-

How do I know that a registration with the Commercial Register, an insurance or VAT was successful?

Once you have created an EasyGov account you will conduct all transactions from your customised EasyGov Cockpit. You will see there which processes you have started and which ones have been successfully completed. The government office in question will decide if a registration has been successful or not; within a few days they will either con-firm your registration or get in touch in case of open questions.

-

Can I use EasyGov without being a registered user?

EasyGov is a transactional portal, not an information website. It helps you manage administrative tasks. To use EasyGov, you will need to register as a user. You can find information regarding Small and Medium Businesses on SECO’s SME Portal.

Questions about Services

-

Who receives a unique Enterprise Identification Number (UID) and how?

Enterprises or institutions receive a UID when they are announced to an authority that is connected to the UID register. -

Which registrations are available if I start a company through EasyGov?

Through EasyGov you can register Sole Proprietorships, Limited Liability Companies (LLC), Public Limited Companies (Ltd), and Limited Partnerships. You can apply for the necessary registrations with the following offices:

- OASI Compensation Office, VAT, and accident insurance for all legal company forms;

- Commercial Register for Sole Proprietorships and Limited Partnerships. EasyGov will initiate the founding act with a notary for LLCs and Ltds. Having your company listed in the Commercial Register is only possible after the foundation has been certified by a notary.

-

Where can I find more information about insurances and taxes?

On SECO’s SME Portal you will find an overview where the various insurances and taxes are explained compre-hensibly.

-

Can I set up an association or a foundation through EasyGov?

Setting up a company with the subsequent Commercial Register registration is currently only possible for Sole Proprietorships, Limited Liability Companies (LLC), Limited Partnerships and Public Limited Companies (Ltd/Inc). It is currently not possible to set up associations or foundations through EasyGov.

-

Which legal form is the best for my company?

You can find a comparison of different legal forms on SECO’s SME Portal. The overview shows the advantages and disadvantages of each form.

-

Where else can I find advice about setting up a company?

Trustees, notaries and cantonal promotion offices will give you advice and support when starting up a company. You also have the possibility of allowing a trustee to access your company on EasyGov. This will enable them to conduct administrative business for your company.

-

Is it possible to make amendments to already existing companies?

Yes, numerous business administration tasks can be conducted digitally on EasyGov. Currently, following tasks are available: Services offered by EasyGov

-

How can I register an already established company with EasyGov?

After creating a user account on EasyGov you can apply for administrator’s rights for an already established company. This application will trigger a power-of-attorney process, which is conducted in writing to safeguard your company’s data.

-

My private residence is not in Switzerland. Can I still establish a company in Switzerland?

For the most accurate information you should address your query to the authorities of the canton where you want to set up a company. On SECO’s SME Portal you will find some basic information.

Notification procedure for short-term employment up to 90 days

-

How do I connect a company, foundation, etc. to EasyGov or request a VAT number?

- Register with EasyGov (see How do I register a CH-login?).

- Log in to EasyGov and click on the blue button «Click here to get started».

- Answer the questions by clicking on the following options:

- ‘I would like to use official services for a company in Switzerland or abroad (or an association, foundation, self-employed person registered in a register, etc.) or set up a company based in Switzerland.’

then

‘I would like to connect an existing company based in Switzerland or abroad (or an association, foundation, self-employed person registered in a register, etc.) or apply for a UID.’

then

‘The company is based in Switzerland / abroad’ (both options are possible)

At the end of the questions, the ‘Company Search’ search field appears on a new page. Enter the name of your company/foundation or the existing UID number and click on the ‘Search’ button. - Select your company or foundation and click on the brown ‘Connect’ button.

- If your company does not appear in the search results and therefore does not yet have a UID, click on the ‘Apply for UID’ button.

- You will be redirected to a new page where you can apply for a UID for companies based abroad.

Please note: You can use the registration procedure directly as soon as you have applied for the UID. You do not have to wait until you have received the UID.

(This is an exception to all other official services on EasyGov and is to ensure that you can comply with the advance notification period of 8 days).What happens next?

Within the next few days, a power of attorney letter will be sent to the registered office of your company or foundation. Please sign this power of attorney and send it back using the enclosed reply envelope. Please note that your company or foundation can only be activated on EasyGov once you have sent back the power of attorney. This is necessary to ensure that your foundation or company data is kept secure. Thank you for your understanding. -

Practical information / User’s Guide / FAQ

First Login and Migration of your Data: Customer Information

User’s Guide and FAQ: Online Notification procedure

Information on the SEM website: sem.admin.ch/notification-procedure

-

Your contacts for the notification procedure - at a glance

State Secretariat for Migration SEM:

sem.admin.ch/notification-procedure

Directives of the State Secretariat for Migration: Directives (German, French, Italian) and Annexes (German, French and Italian)Adresses of cantonal authorities:

Kantonale Behörden für Meldeverfahren (admin.ch)Information on salaries/work, rights/obligations, penalties:

Posting – Welcome to posting.admin.chState Secretariat for Education, Research and Innovation SERI:

Competent Authority for Declaration (admin.ch)Federal Tax Administration FTA – VAT-related matters:

Tax liability, relevant turnover, commencement of tax liability, registration (admin.ch) -

Questions about the Enterprise Identification Number (UID)

What is the UID? FAQ

- The Enterprise Identification Number (UID) is a unique identifier allocated to every company active in Switzerland. The UID consists of nine numbers, is randomly allocated and does not contain any information about the enterprise (anonymous number).

- The enterprise does not incur any cost through the allocation of a UID.

Do I need the UID for the notification procedure?- If you want to use the notification procedure as a company or if you are registered in a foreign register as a self-employed service provider, you need a UID to use the notification procedure.

- You can enter reports immediately after going through the process of “Connect company with registered office abroad”.

Does the UID have any consequences under tax law?- No, the entry in the UID register has no consequences under tax law.

I have two UID numbers. Is there a difference?Yes. The VAT number (UID-MWST) is not the same as the Enterprise Identification Number (UID). Although the two numbers are primarily indistinguishable, they have two different uses:

- You received the VAT registration number when you registered your company in Switzerland for value added tax (VAT). This number is to be used on the invoices you issue to customers for products and services provided. The VAT registration number is linked to the address of the tax representative who represents the company in tax matters in Switzerland, and not to the address of the company. Further information about the VAT number can be found here: Unternehmens-Identifikationsnummer (UID) (in german, french or italien)

- The UID number is the identification number of your company. It is assigned to the foreign company and is only used to carry out the registration procedure. The UID number cannot be used for Swiss VAT purposes and therefore must not appear on customer invoices.

Can I determine the difference between my two UID numbers?- No, at least not directly. If you carry out a reporting procedure and use the UID VAT for this, the authorisation will not be granted. In such a case, use the Enterprise Identification Number (UID) issued to you.

- The VAT number in the UID register UID Version: 4.23.4.0 is the address of the tax representative based in Switzerland, who on behalf of a foreign company fulfils the VAT obligations to the Federal Tax Administration. This is always a Swiss address, for example, a trust office. In addition, the information on VAT liability in Switzerland can be found in the UID register under VAT data.

Which UID number should I indicate on my customer invoices?- Always use the VAT registration number (UID-MWST).

- The UID number that was assigned to your foreign company headquarters as part of the registration procedure cannot be used for Swiss VAT purposes. Therefore, you should avoid mentioning it on customer invoices.

Which UID number should I use to be able to carry out a registration procedure?- The UID number that was assigned to your foreign company headquarters.

- You cannot carry out registration procedures with the VAT number (UID-MWST).

-

I already have a UID as a foreign company, but with an address in Switzerland. Can I use this UID?

No, in this case you have to apply for a new UID with the address abroad if you are a foreign company and wish to use the notification procedure, e.g. for a posting or to register as a self-employed service provider.

Please note: The company can enter and submit returns immediately after submitting the application. There is no need to wait for the authorisation process (issuance of the UID).

-

My company is based abroad but has a branch in Switzerland. Can I use the Swiss branch's UID for the reporting procedure?

The address from the UID register is used for the registration procedure. The address determines whether you can register a start of employment, a posting or a notification for independent service providers.

Therefore: Use your company’s address abroad if, for example, you want to register a posting. In this case, you would have to apply for a UID with the address abroad.

Note: The company can register and submit reports as soon as the application has been submitted. There is no need to wait for the authorisation process (allocation of the UID).

-

I have applied for a UID, how long will it take before I can start filing?

You can use the registration procedure as soon as you have applied for the UID. You do not need to wait until you have received the UID.

(This is an exception to all other government services on EasyGov and is to ensure that you can comply with the 8 day advance notification period). -

I have started the authorisation process. How long does this process take and do I have to wait for the final authorisation before I can start the reporting process?

After the BFS has successfully checked the UID application, EasyGov will send a power of attorney application by post to the company’s registered address. This must be signed by an authorised signatory of the company and authorises the user to register with the authorities on behalf of the company using EasyGov. EasyGov will activate access for the company and notify the user by email once the power of attorney has been signed and returned to EasyGov. This process can take up to 14 days.

Important: Once EasyGov has sent the authorisation request, the registration process can begin. The user will immediately receive a provisional UID number from Easygov and can use it for the reporting procedure until the authorisation process is completed.

-

Is the authorisation process different for a company abroad and a company in Switzerland?

The authorisation process is the same in Switzerland and abroad. A physical Power of Attorney will be sent to the registered address of the client account, which must be signed and returned to EasyGov in order to gain full access to the client account.

-

What happens if a company abroad is not registered in the Trade Register but in another register?

It is not mandatory for a company to be registered in a foreign country. For a successful validation, the Federal Statistical Office (FSO) must compare the company data of the foreign company with a register in your company’s country of origin. This register must be an official register, the most suitable being the commercial register, but other registers are also possible. The options are based on the GLEIF list of relevant registers. An overview of possible registers can be found here: GLEIF Registration Authorities List – Code Lists – LEI – GLEIF

-

How do I use the registration procedure as a trustee?

As part of the registration procedure for private individuals, trustees are another group of individuals entitled to conduct the registration procedure on behalf of their clients. They carry out the whole process – from setting up the private individual’s account to concluding the registration procedure

In order to make it also possible for trustees to conduct registration procedures (i.e. registration activities for private individuals), an eIAM-Account can be used to set up and link several private individuals. Trustees can therefore set up private individuals independently. To do this, the trustee just needs to open EasyGov and sign in using their eIAM-Account. This allows them to set up the respective private individuals in their trustee account on behalf of their clients and can then run registration process using this account for their clients.

Foundations and auditors

-

How do I connect a foundation to EasyGov?

Vidéo : Onboarding EasyGov (MP4, 1.5 MB, 07.06.2022)

- Register on EasyGov (see video “How do I register a CH-login?” above)

- Register on EasyGov and click the blue button “Click here to start.”

- Select the blue button “Click here to connect an existing company.”

- Enter the name of your foundation/company or the company identification number (UID) in the search field.

- Select your foundation or company and click the brown “Connect” button.

What happens next?

Within the next few days, a power of attorney letter will be sent to the registered office of your foundation or company. Please sign this power of attorney and send it back using the enclosed reply envelope. Please note that your foundation or company can only be activated on EasyGov once you have sent back the power of attorney. This is necessary to ensure that your foundation or company data is kept secure. Thank you for your understanding. -

Error message: The information does not match that of the auditor. What to do?

This error message concerns the data entered by you and the auditor for total equity, total liabilities and/or total assets. These must match. Perhaps it is a simple rounding error that triggers this error message.

Maybe the auditor has already entered his data input before you entered it. If your information on screen 5 does not match that of your auditor and this error message appears, we recommend that you contact your auditor. You or the auditor can then adjust the data: you can adjust it via screen 5, your auditor via “Correct details” in screen 4, which can be called up again via the “Archived processes” tab in the cockpit.

Maybe the auditor entered his data after you already had completed your part and you have already reached screen 8. After consulting with the auditor, you can correct the data by clicking on the “Correct details” button on screen 8 before completing the annual reporting. Your other entries remain saved.

SICHEM

-

Where can I find information and FAQs about SICHEM?

Information and FAQs about SICHEM (SIcherer Umgang mit CHEMikalien) can be found on the SICHEM – Safe handling of chemicals – EasyGov landing page or on the SECO website seco.admin.ch/sichem.

Authorisations for official services

-

Can I trigger all official actions as a registered user?

Only users with full access can trigger all official actions. Users with restricted access can only receive or trigger government services that they’ve been authorized to access by a user with full access.

-

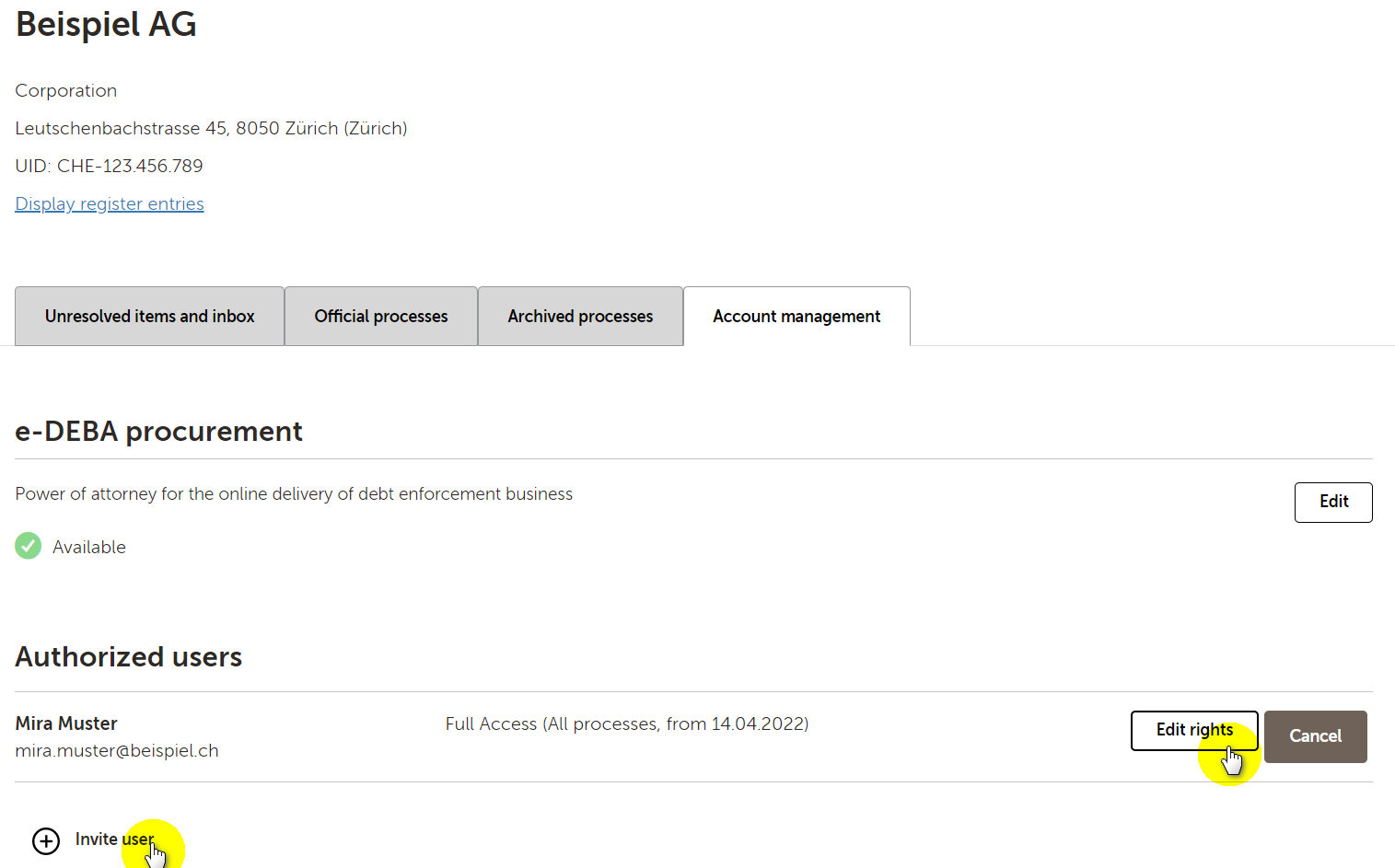

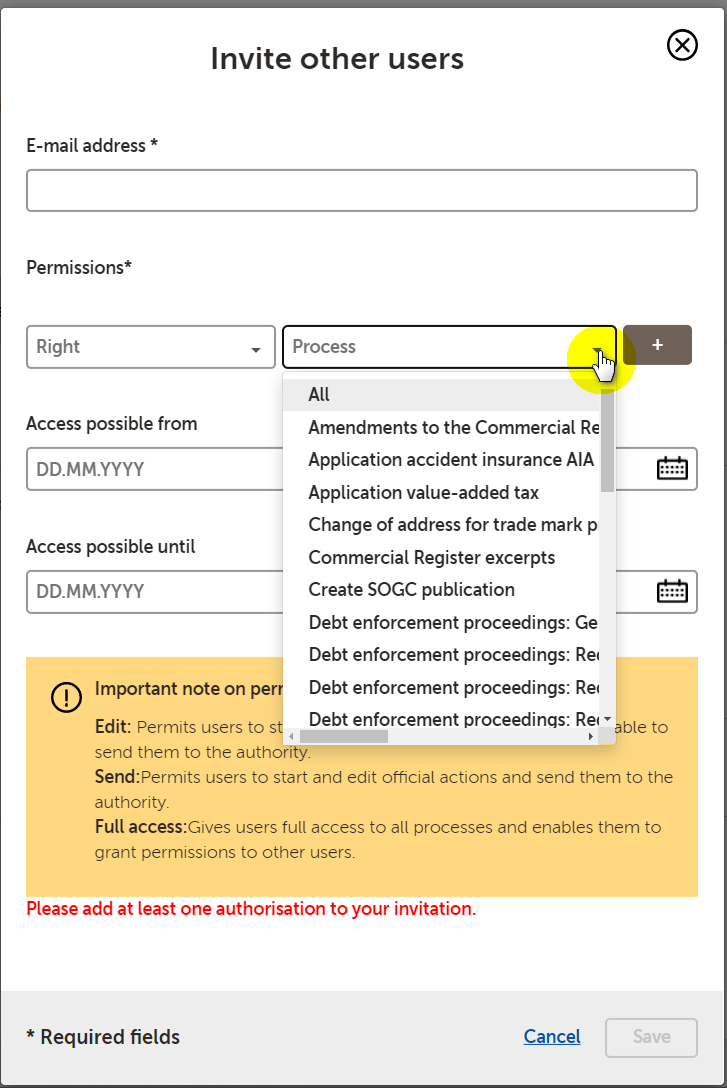

How do I restrict the access rights of employees who have access to EasyGov?

You can find all authorized employees, as well as the option to invite other users, in the Account Management section for your company. Access rights can be set either when inviting employees, or afterwards via “Edit rights”.

-

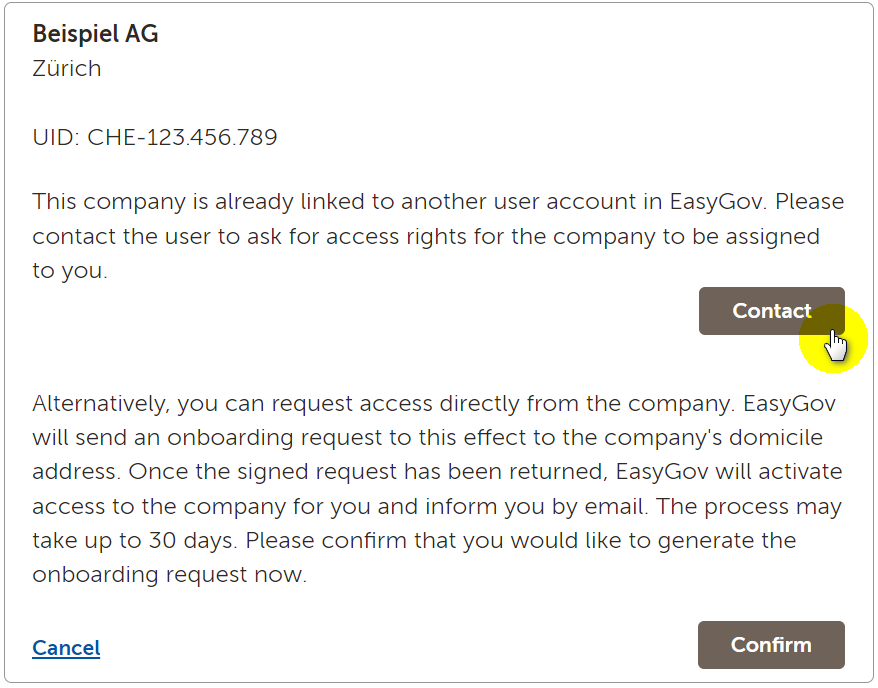

How to I gain access if the company is already registered with EasyGov, but as a new user, I don’t know the EasyGov company administrator?

Search for the company you wish to connect with and then click on “Contact”.

Technical questions

-

The registered email address has not been verified yet, so I cannot log in.

This may be due to following reasons:

- The email address went to your spam folder because it contained a link./li>

- SYou made a mistake when typing in the email address during the signing-up process.

- Your mailbox is full and can therefore not receive any more emails.

- There has been a delay in the delivery of the email.

-

Can I manage my EasyGov account on a tablet and/or smartphone?

It is possible to use EasyGov on tablets or smartphones; however, the view is limited. We recommend using EasyGov on a desktop computer.

-

Can I interrupt a process without losing all the data just put in?

If you would like to interrupt a process, please click on «Continue later». The data you have input will be saved and made available the next time you log in.

-

I have forgotten my password. How can I get a new one?

Please use the button «Forgot password?» on the login page.

-

How to complete processes without media disruption?

Various requests to the authorities presented through the EasyGov platform may require a legally binding signature. A qualified digital signature is necessary to process such requests digitally without having to print out and post documents.

-

Is a handwritten signature required? Can I avoid sending documents by post?

Various requests to the authorities presented through the EasyGov platform may require a legally binding signature. A qualified digital signature is necessary to process such requests digitally without having to print out and post documents.

-

What is a qualified digital signature?

According to Article 14 para. 2bis of the Swiss Code of Obligations, a qualified electronic signature is equivalent to a handwritten signature. What constitutes a qualified electronic signature is governed by the Federal Act on Electronic Signatures (ESigA).

The Swiss Accreditation Service (SAS) publishes a list of the recognised certification services.

-

Which providers of electronic signature solutions (ZertES) are existing?

There are currently the following providers of electronic signature (QES) solutions in Switzerland:

Further information and links

-

What is the return address to EasyGov for the authorisation forms?

Dienstleistungszentrum Datenerfassung BFS

EasyGov.swiss

Postfach 950

8901 Urdorf

SCHWEIZ -

Are there special offers for female entrepreneurs?

On SECO’s SME Portal you will find interesting links and networking possibilities (only in German, French or Italian).

-

These FAQ do not answer my questions. Where can I find help?

Please address your questions to EasyGov’s .